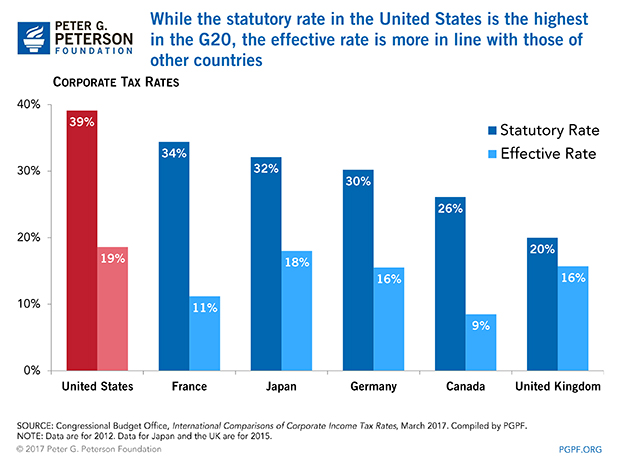

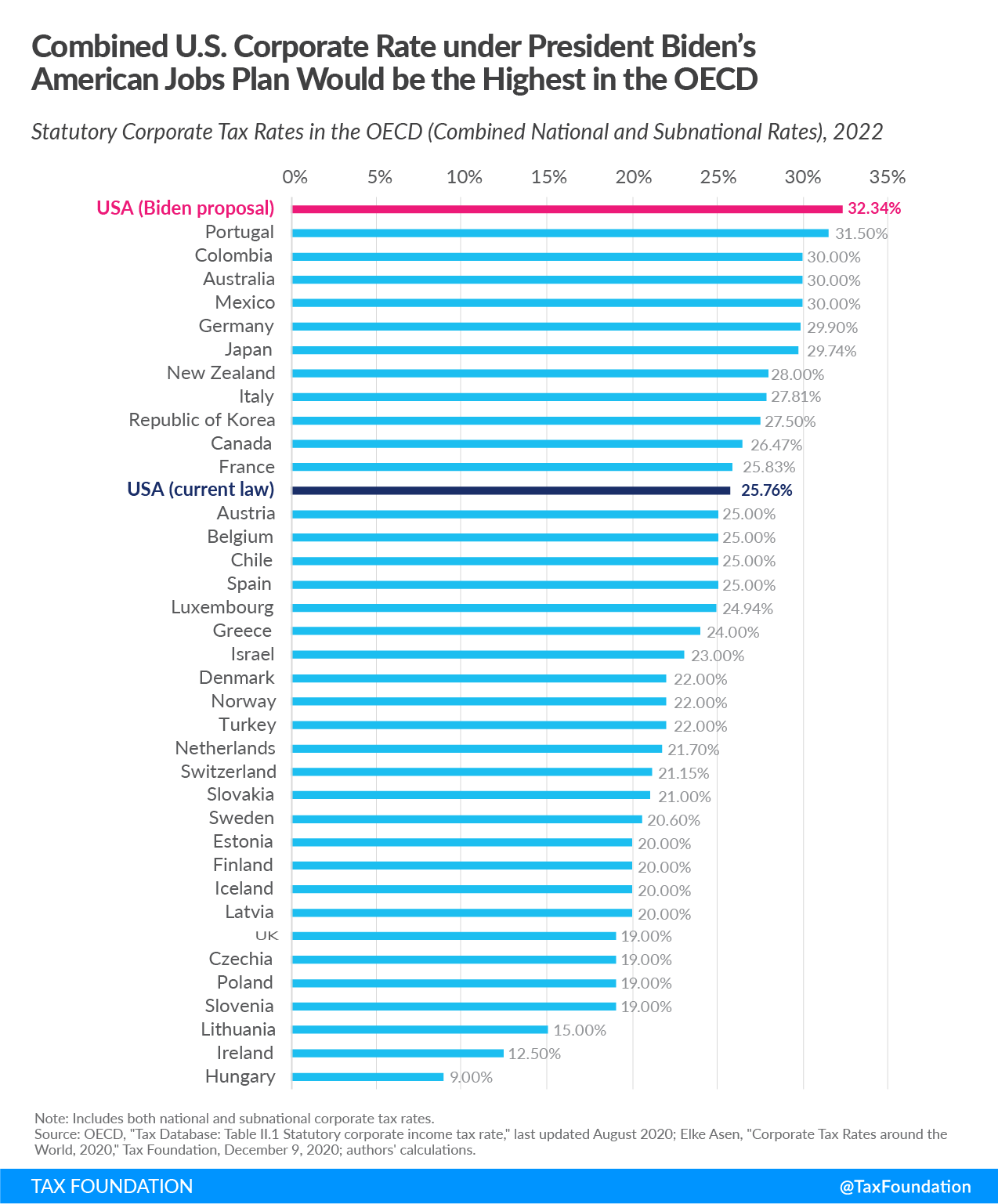

Twitter 上的Tax Foundation:"President Biden's #AmericanJobsPlan looks to increase the federal corporate tax rate to 28%, which would raise the U.S. federal-state combined tax rate to 32.34%, higher than every country in

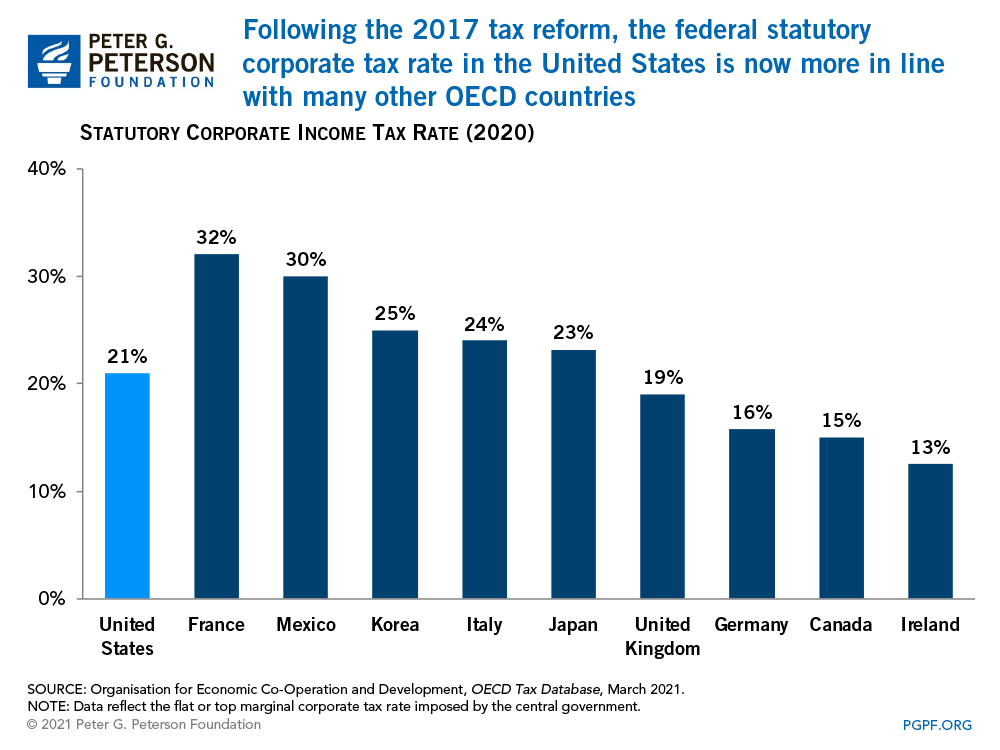

Increasing America's Competitiveness by Lowering the Corporate Tax Rate and Simplifying the Tax Code | Mercatus Center

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)